Fidelity Eduloan Requirements, Eligibility, Repayment and How To Apply

Fidelity Eduloan Eligibility, Structure, Requirements, Interest, Repayment and How To Apply. Fidelity Eduloan is a custom loan product created to fulfill the short- to medium-term funding needs of Nigeria’s legally recognized private educational institutions (primary, secondary, and postsecondary).

Fidelity Bank offers the credit product Eduloan to help private educational Institutions legally recognised in Nigeria. I’ll go into great depth in this response about how to apply for a Fidelity Eduloan as well as the requirements, loan structure, interest rate, and repayment schedule. Outstanding UK Financial Aid for International Students.

REPAYMENT

The Fidelity Eduloan product offers loans to consumers, but the length of such loans vary based on the kind of educational program the borrower is pursuing. The length of the loan payback period is referred to as the tenor. The borrower is required to make consistent payments on the loan during this time until it is entirely repaid. It is crucial to keep in mind that the tenor may change, so it is advised to speak with a Fidelity Bank representative for additional details on the tenor of the Fidelity Eduloan product. The Fidelity Eduloan is structured into;

Term Loan : To fund expansion projects and construction works for schools. To purchase and lease fixed assets such as school buses, generators etc.

Working Capital Finance (Overdraft) – To finance minor renovation works on school property. To finance payment of salaries and procure items such as furniture, educational books, school uniforms, teaching materials etc. Quick Guide to Apply for a CBN Loan

REQUIREMENTS:

To apply for a Fidelity Eduloan, an applicant must provide the following documents:

For Working Capital Finance

- Irrevocable Domiciliation of School Fees

- Personal Guarantee of Proprietor/Prime Promoter plus statement of net worth

- Undated Other bank cheque IFO Fidelity covering 120% of loan amount

For Term Loan

In addition to Irrevocable Domiciliation, Personal Guarantee & Undated Bank cheques, there should be the following:

- Lien on leased Assets

- Legal Mortgage on landed property belonging to Prime Promoter/Proprietor

- Comprehensive insurance cover on all property for 110% of the value with Fidelity noted as the first loss payee. Fidelity Bank NYSC Loan Application Portal

HOW TO APPLY:

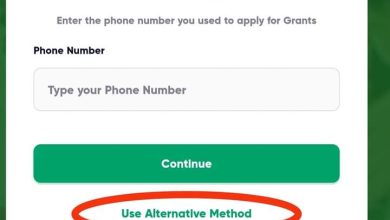

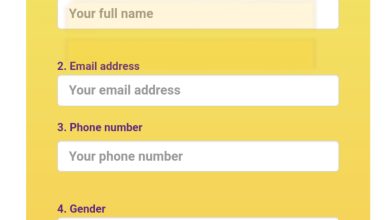

To apply for a Fidelity Eduloan, follow these steps:

a. Visit any Fidelity Bank branch near you and request for a loan application form.

b. Fill out the form and attach all required documents.

c. Submit the application form and documents to the bank.

The Fidelity Eduloan is a great option for legally recognized private educational institutions in Nigeria. The loan has a flexible repayment plan and a competitive interest rate. Visit https://www.fidelitybank.ng/ for more information.