Quick Guide to Apply for a CBN Loan

Apply for a CBN Loan – The Central Bank of Nigeria (CBN) offers various loan schemes to help businesses and individuals in Nigeria access financing for their projects. However, applying for a CBN loan can be a daunting task, especially for first-timers. This article aims to guide you through the process of applying for a Nigeria CBN loan.

Understanding CBN Loan Schemes

The Central Bank of Nigeria (CBN) has implemented several loan schemes to assist businesses and individuals in Nigeria. These schemes aim to address some of the challenges of access to credit faced by many Nigerians. This article seeks to provide a comprehensive understanding of CBN loan schemes, their benefits, and how to access them.

What are CBN Loan Schemes?

CBN loan schemes are credit facilities designed by the Central Bank of Nigeria to provide financing support to businesses, farmers, students, and other individuals in need of funding. The loans are intended to enhance access to affordable finance and promote economic growth.

Importance of CBN Loan Schemes

CBN loan schemes are essential for stimulating economic growth, reducing poverty, and creating job opportunities in Nigeria. They provide a significant boost to entrepreneurship and SME development, thus helping to address the challenges of access to credit in the country.

Types of CBN Loan Schemes

CBN has implemented several loan schemes, and in this section, we will discuss some of the most prominent ones.

1: Anchor Borrowers’ Programme (ABP)

The Anchor Borrowers’ Programme (ABP) is a CBN initiative targeted at smallholder farmers, who account for a significant portion of Nigeria’s population. The program provides loans to farmers to enhance agricultural productivity and ensure food security.

2: Agri-Business/Small and Medium Enterprises Investment Scheme (AGSMEIS)

The Agri-Business/Small and Medium Enterprises Investment Scheme (AGSMEIS) is a CBN loan scheme designed to support agricultural businesses and small and medium-sized enterprises (SMEs). The program aims to enhance access to finance, build capacity, and promote job creation in Nigeria.

3: Micro, Small, and Medium Enterprises Development Fund (MSMEDF)

The Micro, Small, and Medium Enterprises Development Fund (MSMEDF) is a CBN loan scheme created to provide funding support to micro, small, and medium-sized enterprises (MSMEs) in Nigeria. The program’s goal is to enhance the capacity of MSMEs to contribute to economic development.

4: Creative Industry Financing Initiative (CIFI)

The Creative Industry Financing Initiative (CIFI) is a CBN loan scheme targeted at the creative industry in Nigeria. The program provides funding support to individuals and businesses in the creative industry, including fashion, music, movies, and software development.

How to Access CBN Loan Schemes

In this section, we will discuss the steps involved in accessing CBN loan schemes.

1: Identify the Loan Scheme that Meets Your Needs

The first step in accessing CBN loan schemes is to identify the program that meets your needs. You can research the various loan schemes and determine which one is suitable for your business or personal financial goals.

2: Meet the Eligibility Criteria

Once you have identified the loan scheme that meets your needs, the next step is to meet the eligibility criteria. Each loan scheme has specific requirements, and you must meet them to qualify for the loan.

To qualify for a CBN loan, you must meet certain eligibility requirements, which vary depending on the loan scheme. Here are some common requirements:

- Business registration: You must have a registered business in Nigeria to qualify for a CBN loan.

- Bank account: You must have a functional bank account in Nigeria to receive the loan.

- Collateral: Some loan schemes may require collateral to secure the loan.

- Credit history: You must have a good credit history to qualify for a CBN loan.

- Tax identification number (TIN): You must have a valid tax identification number to qualify for a CBN loan.

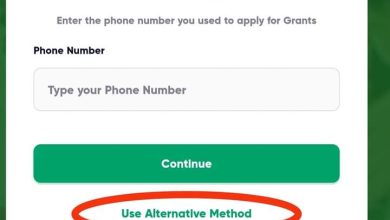

3: Submit an Application

After meeting the eligibility criteria, the next step is to submit an application for the loan scheme. You can download the application form from the CBN website or obtain it from a participating bank.

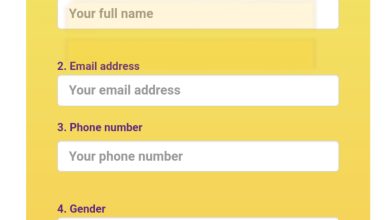

4: Provide the Required Documentation

When submitting your loan application, you must provide the required documentation. The documentation varies depending on the loan scheme and may include a business plan, financial statements, and collateral documents.

5: Wait for Approval

After submitting your loan application and providing the required documentation, you will have to wait for approval. The approval process may take some time, and you may be required to attend an interview or provide additional documentation.

Benefits of CBN Loan Schemes

CBN loan schemes offer several benefits to borrowers, including:

1: Access to Affordable Finance

CBN loan schemes provide access to affordable finance, which is often a challenge for many businesses and individuals in Nigeria. The loan schemes have lower interest rates than commercial banks, making them a more affordable option for borrowers.

2: Capacity Building and Technical Assistance

CBN loan schemes also offer capacity building and technical assistance to borrowers. The programs provide training, mentoring, and business support services to help borrowers develop their businesses and improve their financial management skills.

3: Job Creation

CBN loan schemes promote job creation by supporting small and medium-sized enterprises (SMEs) and other businesses. The loan schemes provide funding support to businesses, which helps them to expand their operations and create job opportunities.

Challenges of Accessing CBN Loan Schemes

Although CBN loan schemes provide several benefits to borrowers, accessing the loans can be challenging. Some of the challenges include:

- Complex Application Process: The application process for CBN loan schemes can be complex and time-consuming. Borrowers may have to provide extensive documentation and attend interviews before their loan applications are approved.

- Collateral Requirements: Most CBN loan schemes require collateral, which can be a challenge for small businesses and individuals who may not have sufficient assets to use as collateral.

- Limited Availability: CBN loan schemes may not be available in all parts of Nigeria, limiting access to finance for some borrowers.

FAQs

1: What is the minimum amount that one can borrow under CBN loan schemes?

The minimum amount varies depending on the loan scheme. Borrowers should consult the specific loan scheme’s terms and conditions for more information.

2: How long does it take to receive approval for a CBN loan?

The approval process varies depending on the loan scheme and the borrower’s eligibility. Some loan schemes may take longer to process than others.

3: Can individuals access CBN loan schemes?

Yes, some CBN loan schemes, such as the AGSMEIS and NIRSAL, are available to individuals as well as businesses.

4: What is collateral, and why is it required for CBN loan schemes?

Collateral is an asset that a borrower pledges as security for a loan. It is required for CBN loan schemes to mitigate the risk of default.

5: How can I find out if I am eligible for a CBN loan scheme?

Borrowers can consult the specific loan scheme’s eligibility criteria on the CBN website or contact a participating bank for more information.

Conclusion

CBN loan schemes are essential for promoting economic growth and addressing the challenges of access to credit in Nigeria. The loan schemes provide affordable finance, capacity building, and job creation opportunities to borrowers. However, accessing the loans can be challenging due to the complex application process, collateral requirements, and limited availability. As such, borrowers should carefully consider their options and meet the eligibility criteria before applying for a CBN loan scheme.