Lendwise Student Loans – How to Apply For Student Loans

Lendwise Student Loans – Are you a student looking for financial assistance to pursue your education? Lendwise student loans can be a great option to consider. Lendwise is a reputable financial institution that offers student loans to eligible individuals seeking higher education. With its competitive interest rates, flexible repayment options, and hassle-free application process, Lendwise aims to make financing education more accessible and affordable. In this article, we will walk you through the process of applying for Lendwise student loans and provide valuable tips to ensure a successful application.

Lendwise Student Loans

Lendwise is a leading provider of student loans designed to help students pursue their educational dreams without financial burden. In this article, we will explore the features, benefits, eligibility criteria, application process, and management options associated with Lendwise student loans. Whether you’re a prospective student or someone looking to refinance existing student loans, Lendwise offers a range of flexible solutions to meet your needs.

Understanding the Importance of Student Loans

The Rising Cost of Education The cost of higher education has been steadily increasing, making it difficult for many students to afford college tuition, textbooks, and living expenses. Student loans bridge the financial gap, allowing students to access education and invest in their future.

Investing in Your Future Obtaining a college degree significantly enhances career prospects and earning potential. Student loans provide the necessary funds to pursue higher education and equip individuals with the skills and knowledge required for success in their chosen fields.

Building Credit History Responsibly managing student loans helps individuals establish a positive credit history, which is crucial for future financial endeavors such as purchasing a home or a car.

Can Nigerian Students Receive Loans from Lendwise?

Lendwise may be the optimal choice for Nigerian students seeking financial assistance to fund their postgraduate studies. This organization specifically aids individuals who aspire to pay for their education at esteemed universities.

Lendwise operates under the regulatory oversight of the Financial Conduct Authority in the United Kingdom, where its headquarters are located. Full-time students who are granted authorization to borrow money through Lendwise will benefit from a grace period, allowing them to commence loan repayment after graduating.

It is worth noting that Lendwise offers competitive and fixed interest rates throughout the entire loan term, although this is contingent upon the applicant’s overall profile. The application process is also streamlined as it is conducted online.

Benefits of Lendwise Student Loans

1: Competitive Interest Rates

Lendwise offers student loans with competitive interest rates, allowing borrowers to save money in the long run. By choosing Lendwise, you can benefit from lower interest charges, reducing the overall cost of your education.

2: Flexible Repayment Options

Lendwise understands the financial challenges students may face after graduation. To ease the burden, they provide flexible repayment options. You can choose from various repayment plans, including income-driven repayment, to ensure your loan payments align with your financial situation.

3: No Cosigner Required

Unlike many other private lenders, Lendwise does not require a cosigner for their student loans. This is advantageous for students who may not have access to a suitable cosigner or want to establish financial independence.

Eligibility Criteria for Getting Lendwise Student Loans

Before applying for Lendwise student loans, it’s important to ensure you meet the eligibility criteria. The following factors are typically considered during the application process:

1: Citizenship and Residency

Lendwise student loans are available to both domestic and international students. However, specific eligibility requirements may vary based on your citizenship and residency status. Make sure to check the eligibility criteria based on your situation.

2: Enrollment in an Eligible Program

Lendwise provides loans for students pursuing various educational programs, including undergraduate and graduate degrees. Ensure that your chosen program is eligible for funding through Lendwise.

3: Good Credit History

Maintaining a good credit history is crucial when applying for student loans. Lendwise evaluates your creditworthiness, including factors such as credit score, credit utilization, and payment history. A strong credit history increases your chances of approval and favorable loan terms.

Steps to Apply for Lendwise Student Loans

Follow these step-by-step instructions to apply for Lendwise student loans:

Step 1: Research and Gather Information

Before starting the application process, research Lendwise student loans thoroughly. Familiarize yourself with the loan terms, loan amounts, interest rates, and repayment options. Gather all the necessary information and documents required for the application.

Step 2: Calculate Loan Amount

Determine the amount of money you need to borrow for your education. Consider tuition fees, living expenses, textbooks, and other educational costs. Use online calculators or consult with financial aid advisors to estimate a reasonable loan amount.

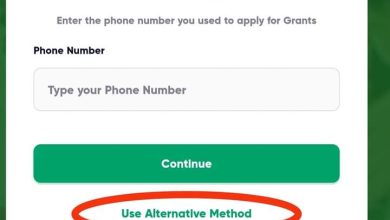

Step 3: Fill out the Application Form

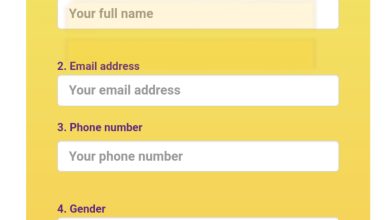

Visit the Lendwise website and navigate to the student loan application page. Fill out the application form with accurate and complete information. Provide details about your personal information, educational background, and financial situation. Be thorough and ensure all fields are correctly filled.

Step 4: Submit Required Documents

Along with the application form, you will need to submit certain documents to support your loan application. These documents may include proof of enrollment, identification documents, income statements, and any other requested financial information. Double-check the requirements and gather all the necessary paperwork.

Step 5: Review and Accept Loan Offer

After submitting your application and documents, Lendwise will review your information. If your application is approved, you will receive a loan offer detailing the terms and conditions. Take the time to carefully review the offer, including interest rates, repayment options, and any associated fees. If you find the offer suitable, accept it according to the provided instructions.

Tips for a Successful Loan Application

To increase your chances of a successful loan application, consider the following tips:

1: Maintain a Good Credit Score

Before applying for Lendwise student loans, focus on building and maintaining a good credit score. Pay your bills on time, keep credit card balances low, and avoid excessive debt. A strong credit score demonstrates your creditworthiness to lenders.

2: Provide Accurate and Complete Information

When filling out the application form, ensure that all the information you provide is accurate and up to date. Any discrepancies or missing details may delay the application process or even result in rejection. Double-check your application before submission.

3: Consider a Cosigner if Needed

While Lendwise does not require a cosigner for their student loans, having one can strengthen your application, especially if you have limited credit history or income. A cosigner with a good credit score and stable financial situation can improve your chances of approval and may even lead to more favorable loan terms.

4: Review Terms and Conditions

Before accepting a loan offer, carefully read and understand the terms and conditions. Pay attention to interest rates, repayment plans, grace periods, and any associated fees. If you have any doubts or questions, reach out to Lendwise for clarification.

Conclusion

Applying for Lendwise student loans can provide the financial support needed to pursue your educational dreams. By following the outlined steps and considering the provided tips, you can navigate the application process with confidence. Remember to gather all the required information, submit accurate documents, and review the terms and conditions before accepting a loan offer. With Lendwise, you can access competitive interest rates, flexible repayment options, and the opportunity to fund your education without the need for a cosigner.