OSLA Student Loan (Your Path to Educational Success)

In today’s fast-paced world, education is the key to unlocking countless opportunities and achieving your dreams. However, pursuing higher education can often be financially daunting. That’s where student loans come in, and one of the notable players in this domain is OSLA (Oklahoma Student Loan Authority).

In this comprehensive guide, we’ll delve into what OSLA student loans are, how they can help you pursue your academic aspirations, and why OSLA might be the ideal choice for your educational funding needs.

What is OSLA Student Loan?

The Oklahoma Student Loan Authority, commonly known as OSLA, is a non-profit organization established with the aim of helping students access affordable and flexible funding options for their education. OSLA operates as a federal student loan servicer, working in partnership with the U.S. Department of Education to provide essential services and financial aid to thousands of aspiring students across the nation.

Benefits of OSLA Student Loans:

a) Competitive Interest Rates: OSLA is committed to offering student loans with competitive interest rates. As a borrower, this means that you won’t be burdened with excessive interest charges, making it more manageable to repay your loans after graduation.

b) Loan Forgiveness Programs: OSLA provides valuable information and support for students who may qualify for loan forgiveness programs based on their chosen career paths or public service roles. This feature can significantly alleviate the financial pressure for students who are considering careers in public service or specific professions.

c) Flexible Repayment Plans: OSLA understands that not all students’ financial situations are the same. As a result, they offer various repayment plans to cater to diverse needs and circumstances. Whether you opt for a standard repayment plan, income-driven plan, or graduated plan, OSLA aims to make your loan repayment journey as smooth as possible.

d) Superior Customer Service: OSLA prides itself on delivering exceptional customer service. Their team of knowledgeable professionals is readily available to assist borrowers with any questions or concerns they may have throughout the loan process and beyond. Having a reliable support system can make all the difference when navigating the complexities of student loans.

How to Apply for OSLA Student Loans:

a) Fill out the FAFSA (Free Application for Federal Student Aid): The first step in obtaining an OSLA student loan is to complete the FAFSA form. This application determines your eligibility for federal financial aid, grants, and loans. It’s crucial to submit the FAFSA as early as possible to maximize your chances of securing the financial assistance you need.

b) Research OSLA’s Loan Offerings: Once your FAFSA is processed, explore the different types of loans offered by OSLA, such as Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans. Familiarize yourself with the terms, interest rates, and repayment options associated with each loan type.

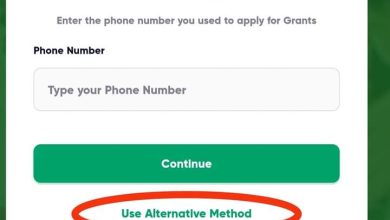

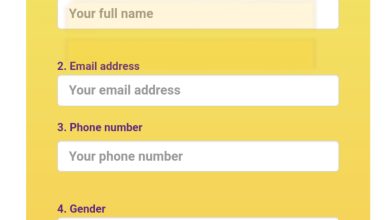

c) Submit Your Loan Application: After researching the available loan options, proceed with the loan application process. OSLA provides a user-friendly platform that allows you to apply online. Be sure to provide accurate information and meet all application deadlines to ensure a smooth processing experience.

Why Choose OSLA Student Loans?

a) A Trusted Partner: OSLA has earned a reputation as a reliable and trustworthy student loan servicer. Their commitment to serving students’ best interests makes them a preferred choice among students and families alike.

b) Financial Literacy Resources: OSLA goes beyond just disbursing loans; they believe in empowering borrowers with financial literacy. They offer a range of resources, budgeting tips, and financial planning tools to help students become financially responsible and successful borrowers.

c) Support Throughout the Loan Lifecycle: OSLA understands that student loans are a significant financial responsibility. Hence, they remain committed to assisting borrowers at every stage of their loan journey, from application to repayment and beyond. This dedication ensures that borrowers can navigate the process with confidence and ease.

Testimonials from OSLA Borrowers:

- “Thanks to OSLA, I was able to focus on my studies without stressing about the financial aspect of college. They made the entire loan process a breeze!” – Emily S., OSLA Borrower.

- “The repayment options offered by OSLA made it manageable for me to pay back my loans without sacrificing my other financial priorities. Their team was always there to answer my questions.” – Mark T., OSLA Borrower.

Pursuing higher education is a transformative journey that can shape your future and unlock a world of possibilities. OSLA understands the challenges faced by students and strives to make quality education accessible to all through their student loan programs. With their competitive interest rates, flexible repayment plans, and unwavering commitment to student success, OSLA is undoubtedly a top choice for aspiring scholars seeking reliable financial support.

Read also: Biden Harris Student Loan Forgiveness

When it comes to investing in your future, OSLA student loans can be your steadfast companion, guiding you towards academic success and a brighter tomorrow. Remember, education is an investment that pays lifelong dividends, and OSLA is here to help you make that dream a reality. Embrace the opportunity, apply for an OSLA student loan, and take the first step towards a promising future filled with endless possibilities.

FAQs – OSLA Student Loan

- What is OSLA Student Loan, and how does it work?

OSLA (Oklahoma Student Loan Authority) is a non-profit organization that operates as a federal student loan servicer. It provides affordable and flexible student loan options to help students fund their higher education. OSLA partners with the U.S. Department of Education to offer federal student loans to eligible borrowers. As a borrower, you can apply for various types of federal loans through OSLA, such as Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans.

- Are OSLA student loans only available to Oklahoma residents?

No, OSLA student loans are not limited to Oklahoma residents. While OSLA is based in Oklahoma, it operates as a federal loan servicer, and its services are available to students across the United States. Students from any state can apply for federal student loans through OSLA.

- What are the benefits of choosing OSLA student loans over private loans?

Choosing OSLA student loans over private loans can offer several advantages. OSLA’s federal student loans typically have lower interest rates compared to many private loan options. Additionally, federal loans often come with more flexible repayment plans, loan forgiveness opportunities, and borrower protections. OSLA also provides excellent customer service and resources to help borrowers manage their loans effectively.

- How do I apply for an OSLA student loan?

To apply for an OSLA student loan, you need to follow these steps:

- a) Complete the FAFSA (Free Application for Federal Student Aid) form to determine your eligibility for federal financial aid.

- b) Research the types of federal loans offered by OSLA, and choose the one that best suits your needs.

- c) Submit your loan application through OSLA’s online platform or as directed by your school’s financial aid office.

- Can I qualify for loan forgiveness with OSLA student loans?

Yes, OSLA provides information and support for borrowers who may qualify for loan forgiveness programs. Depending on your career path or employment in certain public service roles, you might be eligible for loan forgiveness after making qualifying payments for a specific period.